deferred sales trust problems

Questions or Inquires may be made to the trust department. Trust departments can be appointed as a conservator for veterans.

Deferred Sales Trust Defer Capital Gains Tax

Furthermore most Class B shares convert into Class A shares after a certain number of.

. Trust or fund in a deferred exchange. Our financial expert review board allows our readers to not only trust the information they are reading but to act on it as well. 21 2018 Deferred Tax Liability.

The related gross profit of the installments sales is deferred to those period during which cash will be collected. Facebook-f Twitter Youtube Instagram Linkedin. A like-kind exchange under United States tax law also known as a 1031 exchange is a transaction or series of transactions that allows for the disposal of an asset and the acquisition of another replacement asset without generating a current tax liability from the sale of the first assetA like-kind exchange can involve the exchange of one business for another business.

14203 Minuteman Drive 200 Draper UT 84020. Both sales revenue and cost of goods sold are recognized at the point of sale. The Employer-Assisted Housing Program EAHP offers eligible District government employees a deferred 0 interest loan and a matching funds grant for down payment and closing costs to purchase their first single family home condominium or cooperative unit in the District.

Securities and Exchange Commission on May 18 2022. 9000000 x Gross Profit Percentage. Class B shares may include an annual 12b-1 fee andor deferred back-end load sales charges.

An exchange facilitator is a qualified intermediary transferee escrow holder trustee or other person that holds exchange funds for you in a deferred exchange. As receivables are collected a portion of the deferred gross profit equal to the gross profit rate times cash collected is recognized as. 2018 Deferred Tax Liability calculation.

As filed with the US. Leaving Cert results and college offers may be issued later than normal this year a move that universities fear could delay the start of the academic year for thousands of first-year students. Usually contingent deferred sales charges decline each year the investor remains in the fund.

A trust beneficiary for a 401k account is ideal if any of the following scenarios applies to you. 966670 The amount of gain that has not been recognized. You have remarried and want to ensure your second spouse andor children receive.

Consumer New Zealand chief executive Jon Duffy said trust appeared to be eroding in the banking sector compared to last year. 1 Sometimes boot is a choice. Most of our authors are CFP Certified Financial Planners or CRPC Chartered.

For 500000 you exchange mortgage-free property with an adjusted basis of 300000 for a. These examples dont reference closing costs which inevitably reduce both net sales price and net equity. Substantive improvement in retail leasing momentum across the portfolio with growth from both existing and new tenantsFFO per Unit1 for Q1 2022 increased by 002 or 41 as compared to the same period in 2021Progress in zoning approvals on strategic projects together with improved market conditions contributed to 2377 million in incremental.

The offices are located at 10 West Main Street in the Colston Building and the phone number is 580 220-2750. Your beneficiaries have drinking drugs gambling or creditor problems. 14000000 2018 Payment received 5000000 2018 Deferred Obligation.

The election to roll over gain from sale of empowerment zone assets does not apply to sales in tax years beginning after December 31 2020. 8700030 x Maximum capital gains tax rate. Your beneficiaries are young children or grandchildren or a person with special needs.

And thats likely because banks deferred or reduced repayments on. The Trust Department for Citizens Bank Trust Company provides the services listed below.

Deferred Sales Trust Oklahoma Bar Association

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

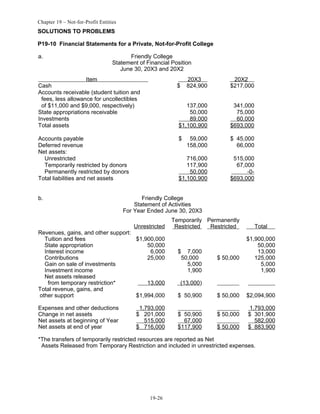

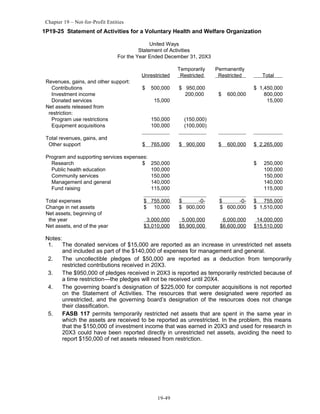

Solusi Manual Advance Acc Zy Chap019

Capital Gains Tax Solutions Deferred Sales Trust

4 Risks To Consider Before Creating A Deferred Sales Trust Reef Point Llc

Capital Gains Tax Solutions Deferred Sales Trust

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust The Other Dst

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust Defer Capital Gains Tax

Solusi Manual Advance Acc Zy Chap019

Capital Gains Tax Solutions Deferred Sales Trust